Individual Taxpayer Identification Number Internal Revenue Service

A Form 1040 return with limited credits is one that’s filed using IRS Form 1040 only (with the exception of the specific covered situations described below). If you’re required to file a tax return and aren’t eligible for a Social Security number, you need to apply for an ITIN (See the What should I do? section, above). A current passport would meet all these requirements and is the only document you can submit on its own. ITIN holders must verify their identity through the video chat process and will need a valid email address, proof of ITIN, one primary document and one secondary document. Taxpayers with an ITIN can complete the registration process to access their IRS online account, which provides balance due, payment history, payment plans, tax records, and more.

International Services

All the exceptions are listed in the ITIN application instructions. The IRS issues ITINs to help people comply with United States tax laws. ITINs help the IRS process tax returns and payments for people who are not eligible for Social Security 30+ research funding agencies that support international collaboration numbers. Beginning January 1, 2011, if you are a paid tax preparer you must use a valid Preparer Tax Identification Number (PTIN) on returns you prepare. If you do not have a PTIN, you must get one by using the new IRS sign-up system.

- You should expect to hear back from the IRS about your approval status after no more than seven weeks — look for a letter in the mail with your ITIN when your application is approved.

- The honorarium statement is automatically generated by GLACIER, once the individual completes their information in the system.

- Individuals who are residents of tax treaty countries receiving an honorarium for a speaking engagement on a B-1 or WB visa must complete their GLACIER record and provide Form 8233 to claim a tax treaty benefit.

- The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

Let Sprintax complete your application.

Once you appeal, a heightened review of your application will take place. You will receive a notification asking you to provide additional information or documents within 7 calendar days from the date of the notification. If a response is not received within the timeframe provided, a determination will be made based on the available information.

Taxpayer identification numbers (TIN)

An email or text message will tell you that your application is being processed. The IRS requires “original documentation or certified copies” of your personal documents with the ITIN application. Please talk with one of our advisors if you’re not sure how to get certified copies. Individuals who are residents of tax treaty countries receiving an honorarium for a speaking engagement on a B-1 or WB visa must complete their GLACIER record and provide Form 8233 to claim a tax treaty benefit. Students who are residents of tax treaty countries receiving a scholarship or fellowship must complete their GLACIER record and provide a W8BEN to claim a tax treaty benefit.

Disclosure of such to any other government agencies, including U.S. From the date of application, fund administrators estimate that review and processing will take approximately six to eight weeks. If an application is incomplete or requires additional information or documents, it may take longer to process the application. As EWF is a new program and volumes are difficult to estimate, timeframes are subject to change. Applicants must provide one or more of the following documents, each showing their name and address within New York State.

The ITIN Application Process

An ITIN may be assigned to an alien dependent from Canada or Mexico if that dependent qualifies a taxpayer for a child or dependent care credit (claimed on Form 2441). The Form 2441 must be attached to Form W-7 along with the U.S. federal tax return. Documents submitted to the DOL as part of the EWF application, including those from employers, are not public records and will be used for the sole purpose of EWF benefits administration.

This allows you to avoid mailing your original documents, or certified copies, to the IRS. The IRS will generally take between 4-8 weeks to process the application. Once the processing is completed they will allocate the ITIN and send the original ITIN https://www.intuit-payroll.org/ certificate to us as your “Certifying Acceptance Agent” we will then send you the original document for your records. Approved applicants will receive a one-time payment on a Visa® prepaid card mailed to the address provided in their application.

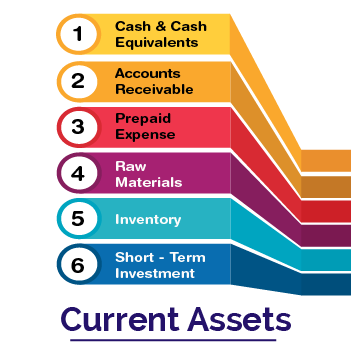

IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers. They are issued regardless of immigration status, because both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code. ITINs do not serve any purpose other than federal tax reporting. You can file Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN), with your federal income tax return. You must also include original documentation or certified copies from the issuing agency to prove identity and foreign status.

They will get you the answer or let you know where to find it. Official websites use .govA .gov website belongs to an official government organization in the United States. If you need an ITIN, find out how to get the state’s Excluded Workers Fund payments.

If you qualify for an exception, then file Form W-7 with your proof of identity and foreign status documents and supporting documentation for the exception. If you don’t owe money on your federal or state tax returns, we recommend waiting until you’re eligible for an SSN to file your tax returns. Applicants who meet one of the exceptions to the requirement to file a tax https://www.adprun.net/23-best-income-generating-assets-invest-in-cash/ return (see the Instructions for Form W-7) must provide documentation to support the exception. Many applicants have reported the IRS lost their passports or other valuable and hard-to-replace identification documents. Consider getting certified copies or using one of the application methods listed below, rather than mailing original identification documents to the IRS.

The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have a Social Security number (SSN). To apply for an ITIN, complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual. Acceptance Agents are entities (colleges, financial institutions, accounting firms, etc.) who are authorized by the IRS to assist applicants in obtaining ITINs.